Give Smarter. Save More. Power a Better Future

Donate Appreciated Stock to Sustainable Northwest

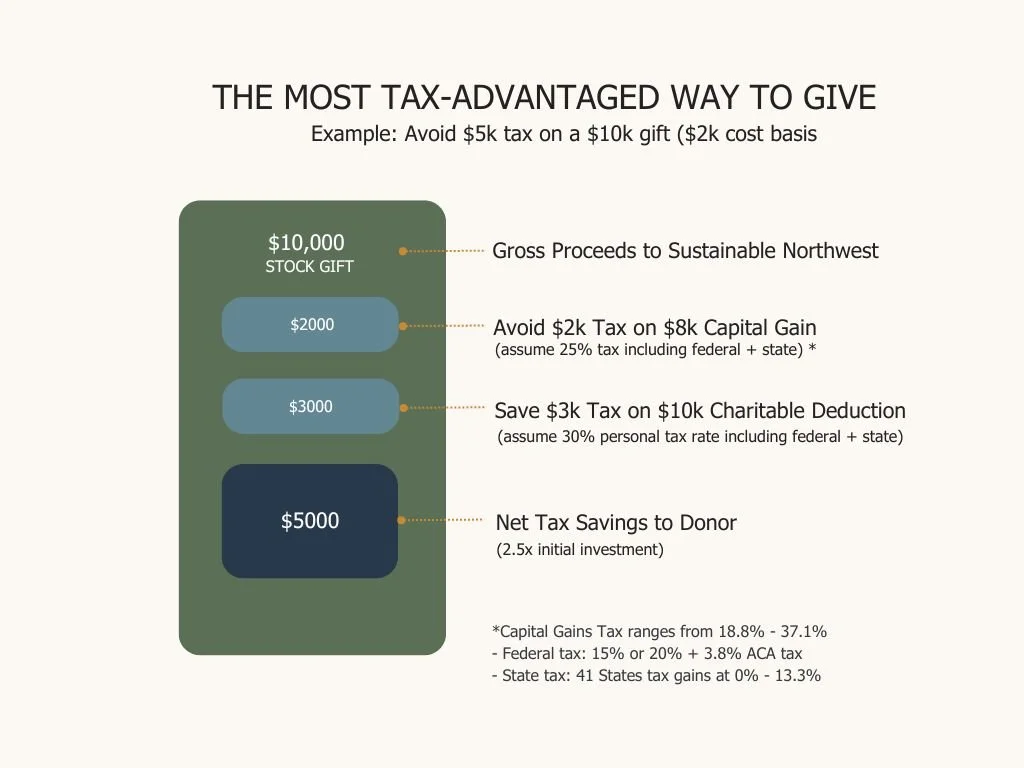

Did you know you can support Sustainable Northwest in one of the most tax-efficient ways possible by donating appreciated stock?

When you donate stock that has increased in value, you can avoid paying capital gains taxes and deduct the full fair market value of the gift from your taxable income. This allows you to maximize your impact without increasing your out-of-pocket expenses. It is a smart way to give and a meaningful way to support our mission.

Why Donate Stock?

When you donate appreciated stock instead of selling it:

-

You save on capital gains taxes

-

You receive a full charitable deduction

-

You receive a full charitable deduction and SNW receives a larger contribution.

This means more resources go directly to supporting vibrant rural communities, resilient landscapes, and a sustainable economy across the Northwest.

Two ways to donate stock

For those who prefer to donate stock online, Sustainable Northwest has partnered with DonateStock.com. In just minutes, you can gift stock directly from your brokerage account through this trusted online portal. DonateStock.com uses advanced security to protect your information and keep your transaction private.

For those who prefer to keep it offline, Sustainable Northwest has created a fillable PDF that you can share with your broker to make stock donations. Click the button below to download the form, fill it out using your computer, tablet, or phone, and email it to your broker. Questions? Contact us.

FAQs

-

Avoid capital gains tax on appreciated securities held for more than one year, which can range from 18.8% to 37.1% depending on your income and state of residence

Receive a charitable tax deduction for the full fair market value of your donated securities

Make a greater impact by giving pre-tax, allowing more of your contribution to directly support Sustainable Northwest’s mission

-

You may donate publicly traded stocks, mutual funds, and ETFs that have been held for more than one year

The securities must not be restricted and must be traded on a major exchange

Your charitable deduction is generally limited to 30% of your adjusted gross income (AGI)

For donations valued over $500, you must file IRS Form 8283 with your tax return

-

While we are not financial advisors, donating stock is a tax-smart way to give. You can potentially avoid capital gains tax, which may range from 18% to 40%, and SNW will receive the full value of your contribution. You may also be eligible to deduct the fair market value of the stock. Please consult a tax professional to understand how this applies to your situation.

-

Yes, DonateStock is built with security and privacy as top priorities. The platform is hosted on one of the world’s most trusted and secure cloud infrastructures. It has successfully passed rigorous security and compliance reviews conducted by some of the nation’s largest and most respected organizations.

-

When you give stock through DonateStock, the shares are transferred directly from your account to an account managed by our trusted partner, DonateStock Charitable, Inc.

No paperwork, phone calls, or emails are required — the entire process is completed online in just a few minutes

Transfers typically take 2–5 business days, and you’ll be notified once your shares have been received

You will receive an acknowledgment letter (tax receipt) from DonateStock Charitable once the donation is complete

Your gift will be valued based on the date the shares are received in the account

Prefer not to use DonateStock?

No problem. Please contact us directly, and we’ll be happy to work with you to ensure your stock gift is processed smoothly and successfully. -

There is no cost to you or your financial advisor to use DonateStock.

-

Ask your advisor to visit the nonprofit’s page on DonateStock.com. From there, they can click “Donate Stock” and select the Advisor option. This will provide them with all the details they need to quickly and easily initiate the donation on your behalf.

-

Yes. Once your stock donation is complete and the proceeds have been distributed to Sustainable Northwest, you can download a receipt from your donor dashboard. The receipt from DonateStock Charitable will reflect the U.S. dollar value of your gift for tax purposes.

-

You will receive an email notification when your donation has been submitted and received. You can also check the status of your stock donations anytime by logging into your donor dashboard.

Prefer another way to give?

We welcome all gifts whether monthly, annual, or one-time. When you are ready to explore the benefits of stock gifting, we are here to make the process easy for you.

Images above: Pahto/Mt Adams as seen from Yakama Indian Reservation, credit Cal Mukumoto. Agency Ranch in Klamath Basin, credit Brendan Byrne.